Swing trading is a great way to take advantage of short to medium-term price momentum in the stock market. The beauty of this style of trading is that you don’t have to sit glued to the screen all day like day traders. Instead, you need to hold stocks for a few days or weeks until they hit your target price.

But here’s the real challenge: picking the right stock. You may have the best strategy in the world, but if the stock itself isn’t suitable for swing trading, you’ll struggle which could lead to longer waiting time. So, how will you know which stocks to pick which are worth your time? Let’s look at the steps to figure it out.

1. Go for Stocks with Good Liquidity

Liquidity simply means how easily a stock can be bought or sold. For swing trading, this is super important. If you choose a stock which does not have high trading volume, you might face a challenge when it’s time to exit.

👉 Quick tip: best way is to look for stocks that trade at least 5 lakh shares a day. Big names in the Nifty 50 or other index-heavy stocks usually tick this box.

2. Look for Healthy Volatility

As a swing trader, you want price movement — otherwise, where’s the profit? At the same time, you don’t want crazy, unpredictable spikes.

- A good stock usually moves 3–5% in a week.

- Avoid penny stocks that jump up and down randomly.

If you want a tool to check volatility, try the ATR (Average True Range).

3. Respect the Trend

There’s an old saying in trading: the trend is your friend. It’s true. If the overall market is going up, it makes sense to ride that wave rather than fight it.

- In an uptrend → Choose stocks making higher highs and higher lows.

- In a downtrend → Look for stocks making lower highs and lower lows.

- Use 50-day and 200-day moving averages to spot the bigger picture trend.

4. Trust a Few Simple Indicators

You don’t need 10 different technical indicators to make good decisions. A few basics are enough:

- RSI (Relative Strength Index): Good to buy when near 40, and take profits when near 60.

- MACD: Helpful to confirm when momentum is shifting.

- Moving Averages: Great for knowing the direction of the stock.

When two or more indicators line up, that’s often a strong signal.

5. Watch for Patterns on the Chart

Charts tell a story if you know what to look for.

- Breakouts: Price crossing above a resistance level.

- Pullbacks: Small dips in an uptrend (often the best time to enter).

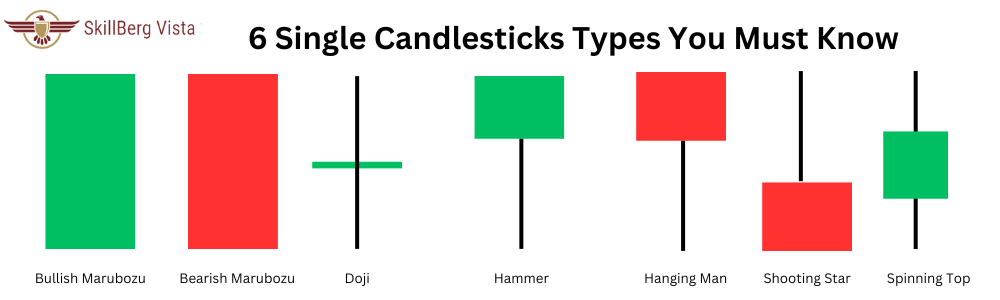

- Candlestick patterns: Like hammers, dojis, or engulfing candles, which signal reversals.

Spend some time studying past charts — it sharpens your eye.

6. Stick with Strong Sectors

Sectors move in groups. If banking stocks are doing well, most bank stocks will follow. If IT is struggling, even good companies in that sector may stay weak.

So, the recommendation is to stay focused and key an eye on sector performance. It’s like swimming with the current instead of against it.

7. Avoid the Traps

A common mistake is chasing “hot news” stocks or tiny illiquid ones. These can move wildly and trap your money.

Instead, stick to reliable, high-volume companies that give you cleaner setups.

8.Utilize Stock Screeners to Save Your Time

It is nearly impossible to check every stock manually. Here stock screener could be of great help. Platforms like screener.ai, TradingView, Moneycontrol, or Finviz help you filter stocks based on volume, moving averages, or RSI and more

👉 Example: Set filter as

- Volume more than 500,000 shares.

- Price above 50-day SMA (moving average). and

- RSI between 40–60.

This gives you a ready-made shortlist in minutes.

9. Always Manage Your Risk

Even the best stock setup can fail. That’s why risk management is non-negotiable.

- Place a stop-loss to protect your money.

- Set a goal of risk-reward ratio of 1:2 (i.e risk ₹100 to make ₹200).

- Take risk of only 1–2% of your account on one trade.

This way you can manage risk and ensure one bad trade won’t hurt your account.

10. Keep a Trading Journal

Here’s a secret: journaling your trades is one of the fastest ways to improve. Write down:

- Why you chose the stock.

- Your entry and exit.

- Profit or loss.

- What you learned.

Reviewing your journal helps you avoid repeating mistakes.

Final Thoughts

One must not complicate the selection of the right stock for swing trading. Focus and figure out stocks with liquidity, volatility, trend, and strong technical signals. Keep a check on sector strength and do proper risk management and you can have a system for making profits.

The key to success in swing trading is not chasing every opportunity but to take trade at the right stock and at the right time.